As A Business Owner, Can You Liquidate Your Company If You Have a Bounce Back Loan?

Thousands of small businesses due to start repaying Covid support loans could find themselves unable to make payments. Can you wind up your company if it already has a Bounce Back Loan? A new legislative measure preventing company directors from informally closing their business to avoid an investigation into director conduct, instead of entering a […]

11 Strategies Every Financial Advisor Needs to Have Difficult Conversations with Their Clients

Hey, we need to talk…. For many of us, this is one of the scariest phrases , especially if you are a financial advisor. Like all professionals, financial advisors may have blind spots when it comes to having difficult conversations. And yet the ability to have these conversations with other people is one of the […]

What Is The Recovery Loan Scheme?

The Recovery Loan Scheme (RLS) was announced by the Chancellor in the Spring Budget and replaces the previous coronavirus loan schemes (Bounce Back Loan Scheme / Coronavirus Business Interruption Loan Scheme / Coronavirus Large Business Interruption Loan Scheme), which closed to applications at the end of March 2021. The RLS has been designed to help […]

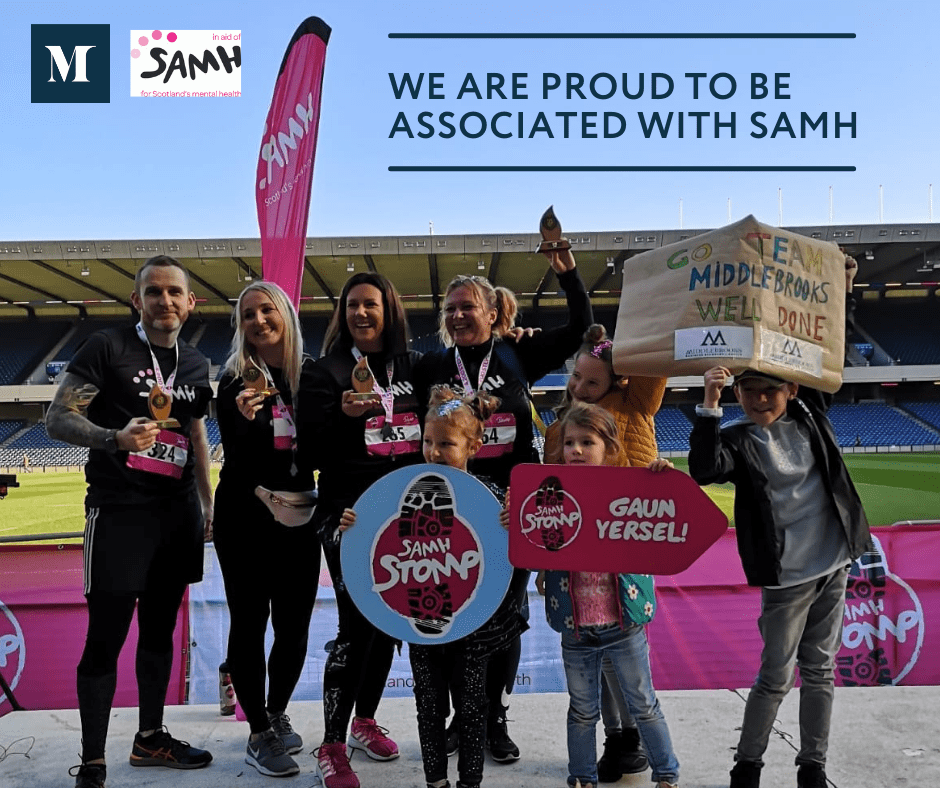

Mental Health Awareness : Why We Associated with SAMH (Scottish Association for Mental Health)

At Middlebrooks, supporting the health and well being of our team members and clients is an integral part of our ethos. This year, we will be working hard to raise awareness and support the initiative in collaboration with SAMH (Scottish Association For Mental Health). It is our vision to help our clients in financial distress […]

As a Director of a Company when Should You start Insolvency Process?

An unexpected downturn in the market can easily have severe implications on business. This is true, even if your company’s financial situation has never been a cause for concern. It’s important to know if a business is in trouble because directors who continue to trade while the business is insolvent risk being made personally responsible for company debts, […]

What does an Insolvency Practitioner do?

Behind any firm that can offer personal and company insolvency services, there is a licensed Insolvency Practitioner or IP. When seeking advice on company insolvency or otherwise, you should always check that the firm has an insolvency practitioner working for them. The IP must be regulated by one of the professional bodies, such as the […]

What types of Insolvency Procedures can be Applied to a Limited Company or a Partnership?

Insolvency describes a situation when a company (or individual) can’t pay what they owe on time, or when the value of their assets is less than the money they owe. The law (mainly the Insolvency Act 1986) sets out formal legal processes for insolvent companies. Not every business with a debt problem ends up needing […]

What happens to an Overdrawn Director’s Loan Account in Liquidation?

An overdrawn director’s loan account is simply a director’s loan that has not been repaid. It is quite common for the directors of limited companies to take money out of the business in some form other than a dividend or salary. If they do, any money they take is considered to be a loan from […]